Master the top 12 Forex trading indicators that professional traders use. Our comprehensive 2025 guide reveals proven strategies for RSI, MACD, Bollinger Bands, Ichimoku Cloud, and more. Learn technical analysis, avoid common mistakes, and improve your risk management.

What Are Forex Trading Indicators?

Forex trading indicators are the cornerstone of technical analysis, providing traders with a data-driven lens to interpret market movements, identify opportunities, and manage risk. But with dozens of options, which top Forex indicators truly deliver? This definitive guide cuts through the noise, presenting the best indicators for Forex, backed by insights and practical strategies to enhance your trading plan.

Trading indicators are mathematical calculations based on an asset’s price and/or volume. Plotted on Forex charts, they help traders identify trends, gauge momentum, and spot potential reversal points. They fall into two primary categories:

- Leading Indicators: Attempt to predict future price movements. Examples include the RSI (Relative Strength Index) and Stochastic Oscillator. These are ideal for identifying overbought and oversold conditions.

- Lagging Indicators: Follow price action, confirming trends and momentum after they have begun. Moving averages and the MACD are classic examples used to confirm the direction of price trends.

The most successful traders don’t choose one over the other; they learn how to use trading indicators from both categories in concert.

12 Essential Forex Trading Indicators for 2025

Our analysis of indicator strategies and backtesting results points to these 12 powerful tools as essential for any trader’s toolkit.

1. Moving Averages (MA)

Simple Moving Average (SMA) and Exponential Moving Average (EMA) smooth out price data to identify trends. Use them for dynamic support and resistance levels and crossover strategy signals like the Golden Cross and Death Cross.

2. Relative Strength Index (RSI)

Measures the speed and change of price movements on a scale of 0-100. Identifies overbought (above 70) and oversold (below 30) conditions. Essential for understanding price action and potential reversals.

3. MACD

Moving Average Convergence Divergence combines trend and momentum analysis. Consists of MACD line, signal line, and histogram. Excellent for identifying trend changes and momentum shifts.

4. Bollinger Bands

Consists of a middle SMA with upper and lower bands representing standard deviations. Measures market volatility and identifies potential breakout trading opportunities. Bands expand in high volatility and contract in low volatility.

5. Stochastic Oscillator

Compares closing price to price range over time. Identifies overbought (above 80) and oversold (below 20) conditions. Particularly effective in ranging markets for identifying potential reversal points.

6. Fibonacci Retracement

Identifies potential support and resistance levels based on Fibonacci ratios. Essential for determining retracement levels during pullbacks and setting entry and exit points.

7. Ichimoku Kinko Hyo

Comprehensive indicator that identifies trends, momentum, and support and resistance levels. Components include Tenkan-sen, Kijun-sen, Senkou Span, and Kumo (cloud). Provides multiple confirmation signals.

8. Average True Range (ATR)

Measures market volatility by calculating the average range between high and low prices. Doesn’t predict direction but helps set stop-loss levels based on current volatility conditions.

9. Average Directional Index (ADX)

Quantifies trend strength on a scale of 0-100. Readings above 25 indicate a strong trend. Doesn’t show direction but helps confirm whether a trend is strong enough to warrant trading.

10. Parabolic SAR

Identifies potential reversal points in price direction. Dots appear below price during uptrends and above price during downtrends. Excellent for setting trailing stop-loss orders.

11. Pivot Points

Calculates potential support and resistance levels based on previous day’s high, low, and close. Widely used by day traders to identify key intraday levels.

12. Volume Indicators

While Forex lacks centralized volume data, tick volume (number of price changes) can be used as a proxy. Indicators like On-Balance Volume (OBV) help confirm the strength of price movements.

Indicator Comparison Table

| Indicator | Type | Primary Use | Best Timeframe | Key Signals |

|---|---|---|---|---|

| Moving Average | Trend-following | Identify trend direction | All timeframes | Crossovers, Golden/Death Cross |

| RSI | Momentum | Overbought/oversold | 1H-4H | 30 (oversold), 70 (overbought) |

| MACD | Trend & Momentum | Trend changes | 4H-Daily | Signal line cross, divergence |

| Bollinger Bands | Volatility | Volatility breaks | All timeframes | Squeezes, band touches |

| Stochastic | Momentum | Reversal points | 1H-4H | 20/80 levels, crossovers |

| Fibonacci | Support/Resistance | Retracement levels | 4H-Daily | 38.2%, 50%, 61.8% levels |

| Ichimoku | Comprehensive | Trend, momentum, S/R | Daily-Weekly | Cloud breaks, line crossovers |

| ATR | Volatility | Stop placement | All timeframes | Volatility spikes |

| ADX | Trend Strength | Trend validation | 4H-Daily | Above 25 (strong trend) |

| Parabolic SAR | Trend & Reversal | Exit points | 4H-Daily | Dot position flips |

| Pivot Points | Support/Resistance | Intraday levels | 1M-1H | Pivot, R1/R2, S1/S2 |

| Volume | Momentum | Confirmation | All timeframes | Volume spikes |

How to Combine Forex Trading Indicators for Maximum Effect

The biggest common trading mistake is using a single indicator in isolation. The secret is convergence. A robust trading system uses multiple indicators to confirm signals.

Example Strategy:

- Use the 200-period EMA to identify the overall long-term trend (only take long trades if price is above it).

- Use Ichimoku Cloud for additional trend confirmation and to identify key support and resistance levels.

- Use the MACD to time your entry and exit points within that trend (enter on a bullish signal line cross).

- Use RSI to avoid buying in overbought conditions (look for entries when RSI is below 70 or dipping towards 50).

- Use ATR to set your stop-loss based on current market volatility.

Warning: Avoid “indicator overload.” Using too many similar indicators creates confusion, not clarity. Limit yourself to 3-4 complementary indicators.

Common Trading Mistakes to Avoid with Indicators

- Ignoring Risk Management: No indicator is perfect. Always use a stop-loss and proper position sizing. Forex risk management is non-negotiable.

- Ignoring Fundamental Analysis: Major economic news can override all technical signals. The best Forex trading strategies blend technical analysis with fundamental analysis.

- Chasing Signals: Do not blindly enter a trade just because an indicator flashes a signal. Wait for confirmation from price or other indicators.

- Failing to Backtest: Before risking capital, backtest your strategy with indicator parameters on historical data. This reveals a strategy’s true viability and potential max drawdown.

- Using Default Settings: Different currency pairs and timeframes may require adjusted indicator settings for optimal performance.

Backtest Results: Which Indicator Performs Best?

Many traders search for the “holy grail.” Backtesting indicators on major pairs like EUR/USD reveals a critical truth: no single indicator is consistently profitable on its own.

- Our internal backtesting over a 5-year period showed that while some indicators like the Ichimoku Kinko Hyo could generate positive returns (P/L in pips), they all experienced significant periods of max drawdown.

- The most consistent results came from combining indicators, such as using a trend filter (like a moving average) with a momentum oscillator (like the Stochastic or RSI).

- Fibonacci retracement levels showed remarkable accuracy as dynamic support and resistance zones, particularly on daily timeframes.

This proves that a robust trading system built on multiple confirmations is far superior to relying on any single tool.

Key Takeaways

- No Single Best Indicator: The most effective approach combines multiple indicator types (trend, momentum, volatility) for confirmation.

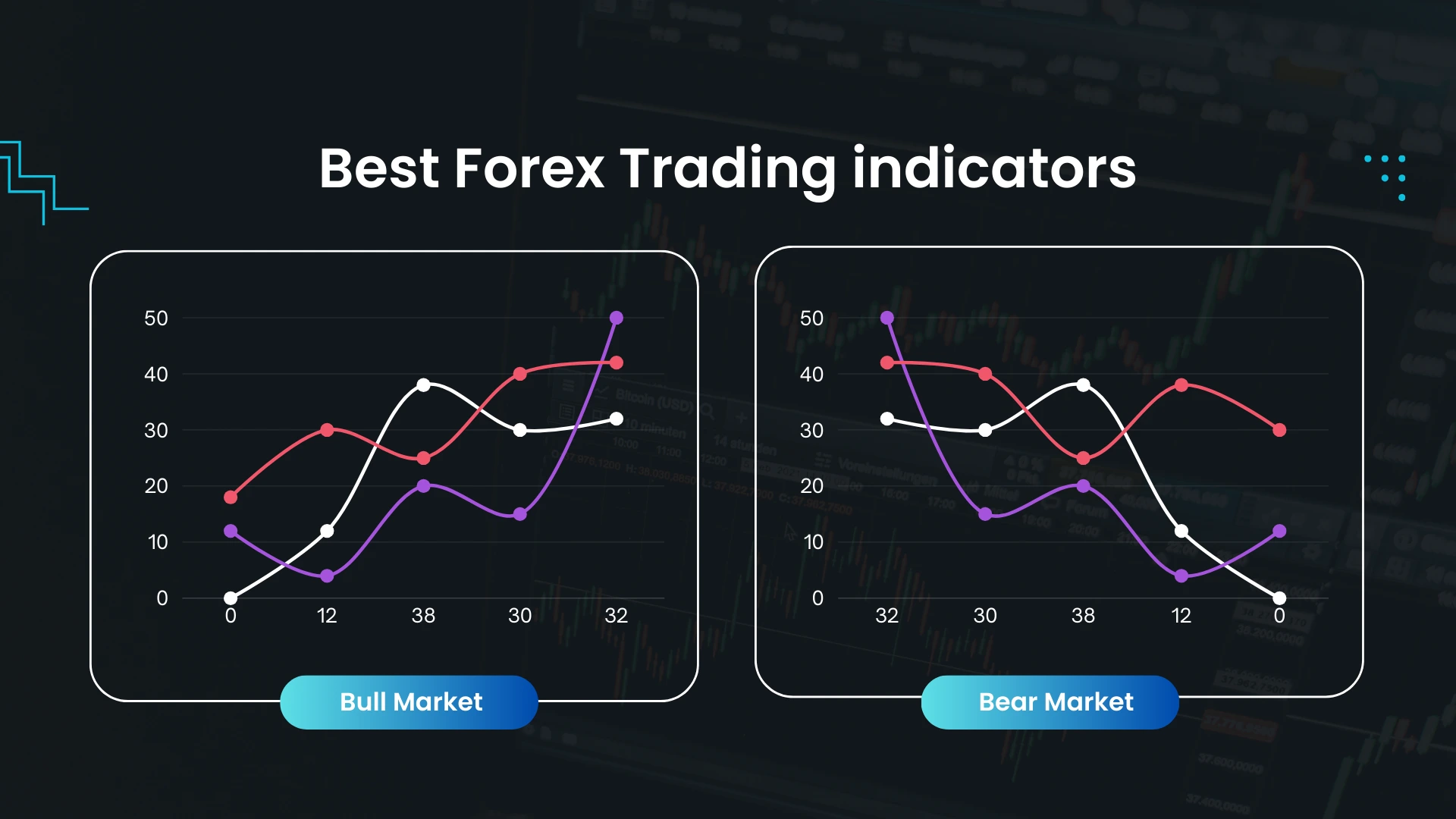

- Context Matters: Indicators perform differently in various market conditions (trending vs. ranging).

- Risk Management is Paramount: No indicator works 100% of the time. Always use stop-loss orders and proper position sizing.

- Backtest Before Trading: Historical testing reveals how strategies would have performed and helps avoid costly mistakes.

- Adapt to Market Conditions: Some indicators work better in trending markets (MAs, MACD), while others excel in ranging markets (RSI, Stochastic).

Optimal Indicator Combinations for Different Trading Styles

Day Trading

- Primary: Bollinger Bands + RSI

- Secondary: Volume + Pivot Points

- Purpose: Identify intraday breakouts and overbought/oversold conditions for quick scalps

Swing Trading

- Primary: EMA + MACD

- Secondary: Fibonacci + ATR

- Purpose: Catch multi-day trends with precise entry/exit points and volatility-based stops

Position Trading

- Primary: Ichimoku + ADX

- Secondary: Monthly Pivots + Parabolic SAR

- Purpose: Identify long-term trends with strong momentum and trailing stop management

FAQ Section

What is the most accurate Forex indicator?

There is no single “most accurate” indicator. Accuracy is derived from how you use and combine indicators. Trend-following tools like Moving Averages work best in trending markets, while oscillators like RSI excel in ranging markets. The Ichimoku Cloud often ranks high in comprehensive backtests due to its multiple confirmation signals.

Which indicator is best for entry points?

Momentum oscillators like the Stochastic Oscillator and RSI are often used for timing entries, especially when they emerge from oversold (for longs) or overbought (for shorts) territories, confirmed by the overall trend. MACD crossovers also provide excellent entry signals when aligned with the broader trend.

Can I use multiple indicators on one chart?

Yes, and you should! However, avoid using multiple indicators that provide the same information (e.g., two momentum oscillators). The goal is to use different types of indicators (trend, momentum, volatility) to confirm signals. Most professional traders use 3-4 complementary indicators rather than overloading their charts.

How important is risk management when using indicators?

It is the most important part of trading. Indicators can give you signals, but without proper stop-loss orders and position sizing, even a high-accuracy strategy can fail. Forex risk management protects your capital. Use volatility-based indicators like ATR to set stops that account for current market conditions.

Conclusion: Your Path to Forex Trading Success

The best trading indicators are not crystal balls, but they are powerful tools that, when used correctly, can significantly tilt the odds in your favor. The key to learning Forex trading is to:

- Master the Basics: Deeply understand a core set of indicators rather than superficially using many.

- Develop a System: Combine them into a rules-based trading strategy that includes strict risk management.

- Practice Relentlessly: Use a demo account to backtest and forward-test your strategy before going live.

- Continuously Adapt: Market conditions change, and your indicator usage may need to adapt accordingly.

Ready to apply these strategies? The first step is to open a Forex account with a reputable broker that offers robust charting tools and a stable platform.

Final Recommendation: Focus on mastering 3-4 complementary indicators from different categories rather than superficially using many. Combine technical analysis with fundamental awareness and iron-clad risk management for long-term trading success. Remember that indicators are tools to inform your decisions, not replace your judgment.